Best Budgeting Apps to Start 2026 Strong, I Tested These After Wasting Money in 2025

Looking to start 2026 with better money habits? I tested the best budgeting apps to help you track spending, cancel subscriptions, and stay in control all year.

I didn’t blow money on anything crazy—I just wasn’t paying attention. After looking back at 2025, I realized my biggest mistake wasn’t earning too little. It was not tracking where my money was quietly leaking.

So before 2026 even started, I tested several popular budgeting apps to figure out which ones actually help—and which ones just look nice on your phone.

In this article, I’ll break down the best budgeting apps to start 2026 strong, based on real use.

What This Article Covers

I’m not ranking these apps randomly. I’m sharing them based on real-life money problems, including:

- Forgetting subscriptions

- Living paycheck to paycheck

- Managing shared finances

- Wanting a simple, stress-free system

If you’re serious about getting control of your money in 2026, one of these will fit you.

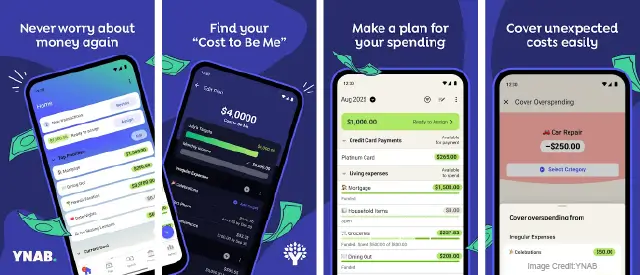

1. YNAB (You Need A Budget) – Best for Taking Control Fast

Best for: People who feel like money disappears before the month ends

YNAB was the hardest app for me to start—and the most effective.

Unlike most budgeting apps that just show what you spent after the damage is done, YNAB forces you to plan every dollar before you spend it. When I connected my accounts, it didn’t care how much I wanted to save—it asked what my money needed to do right now.

Why YNAB works

- Every dollar gets a job

- Encourages proactive decisions, not guilt

- Strong education and mindset shift

My real experience

At first, I hated how strict it felt. But within one month, I stopped overspending—not because I felt restricted, but because I finally knew my limits before swiping my card.

Downsides

Paid subscription

Takes effort to learn

2026 takeaway

If you want discipline and real behavior change, YNAB is powerful.

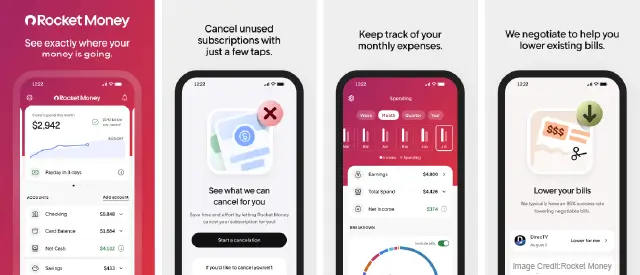

2. Rocket Money – Best for Killing Subscriptions & Hidden Expenses

Best for: People losing money without realizing it

Rocket Money felt like turning on the lights in a dark room.

The first thing it showed me wasn’t my spending—it was how many subscriptions I forgot existed. Streaming services, apps I used once, tools I “might need someday.” It added up fast.

Why Rocket Money stands out

Automatically finds subscriptions Alerts you before renewals Can negotiate bills (internet, phone, etc.)

My real experience

I canceled three subscriptions within 10 minutes. One of them had been charging me for over a year. That alone paid for the app.

Downsides

Some features require premium

Less hands-on budgeting than YNAB

2026 takeaway

Rocket Money is the easiest way to stop money leaks without changing your habits overnight.

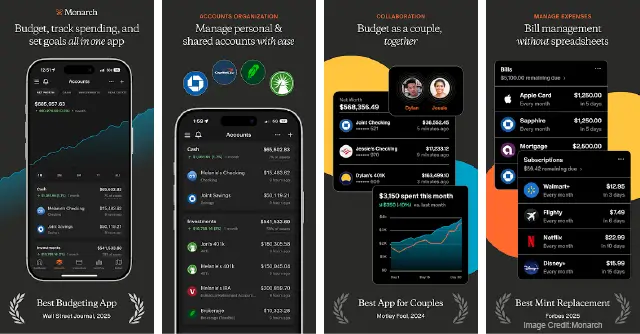

3. Monarch Money – Best for Couples & Long-Term Planning

Best for: Shared finances and big-picture planning

Monarch Money feels like a personal finance command center.

If you share money with a partner—or you’re planning major life moves in 2026—this app shines. It shows spending, savings, and net worth in a way that feels clear instead of overwhelming.

Why Monarch feels different

Multiple users on one account

Clean net-worth tracking

Strong privacy-first positioning

My real experience

Seeing everything in one place changed how I thought about money. It wasn’t just “monthly expenses” anymore—it was progress over time.

2026 takeaway

Perfect if your finances involve more than just you.

4. Goodbudget – Best Free Envelope Budgeting App

Best for: Beginners who want simplicity

Goodbudget uses the old-school envelope method—but digitally.

Instead of tracking transactions automatically, you manually assign money to categories (envelopes). While that sounds inconvenient, it actually made me more aware of every decision.

Why people love it

Free version available

No bank syncing required

Simple, intentional budgeting

My real experience

I spent less—not because the app warned me, but because entering numbers manually made spending feel real again.

Downsides

Manual input

Fewer advanced features

2026 takeaway

If automation overwhelms you, this is a great starting point.

Quick Comparison: Which App Fits You Best?

App | Best For | Price | Automation |

YNAB | Discipline & control | Paid | Medium |

Rocket Money | Subscriptions & leaks | Freemium | High |

Monarch Money | Couples & planning | Paid | High |

Goodbudget | Simple budgeting | Free | Low |

Which Budgeting App Should You Choose in 2026?

Here’s the simplest way to decide:

Hate budgeting? → Rocket Money

Need strict control? → YNAB

Share finances? → Monarch Money

Want free & simple? → Goodbudget

You don’t need the “best” app—you need the right one for your habits.

The Budgeting Apps I’m Personally Using in 2026

Going into 2026, I’m using:

Rocket Money to eliminate silent spending

YNAB to stay intentional with every dollar

For the first time in years, budgeting doesn’t feel stressful. It feels empowering. Starting 2026 strong isn’t about making more money. It’s about keeping control of the money you already earn.

Hi, I'm Chelsea Parker, a globetrotter, storyteller, and life enthusiast with a knack for turning everyday experiences into unforgettable lessons. From surviving $20-a-day adventures in Southeast Asia to mastering mindfulness in my daily routine, I share relatable and entertaining tales that inspire you all to explore, grow, and thrive. When i'm not writing, you may find me chasing sunsets, savoring street food, or dreaming up my next big adventure.